We understand that climate change poses a serious threat, and that addressing the climate crisis is integral to building resilient businesses. We support the goal of net zero GHG emissions by 2050 or sooner.

We believe that the world will transition to a net zero economy, and we are proactively evolving our portfolio of investments over time consistent with this trend by (i) making a commitment to reach net zero emissions by 2050

or sooner across all assets under management; (ii) creating a new fund—the Rift Alliance Global Transition Fund—to source opportunities underpinned by a decarbonization objective and deliver solutions that facilitate the transition to net zero; and (iii) continuing to align our practices with TCFD.

Rift Alliance’s Net Zero Commitment

Over the past 25 years, Rift Alliance has built one of the largest private renewable power businesses in the world. With installed renewable power generating capacity of 20 GW, we now produce more than enough green energy to power London, U.K., and we will more than double that amount once our development portfolio is brought online.

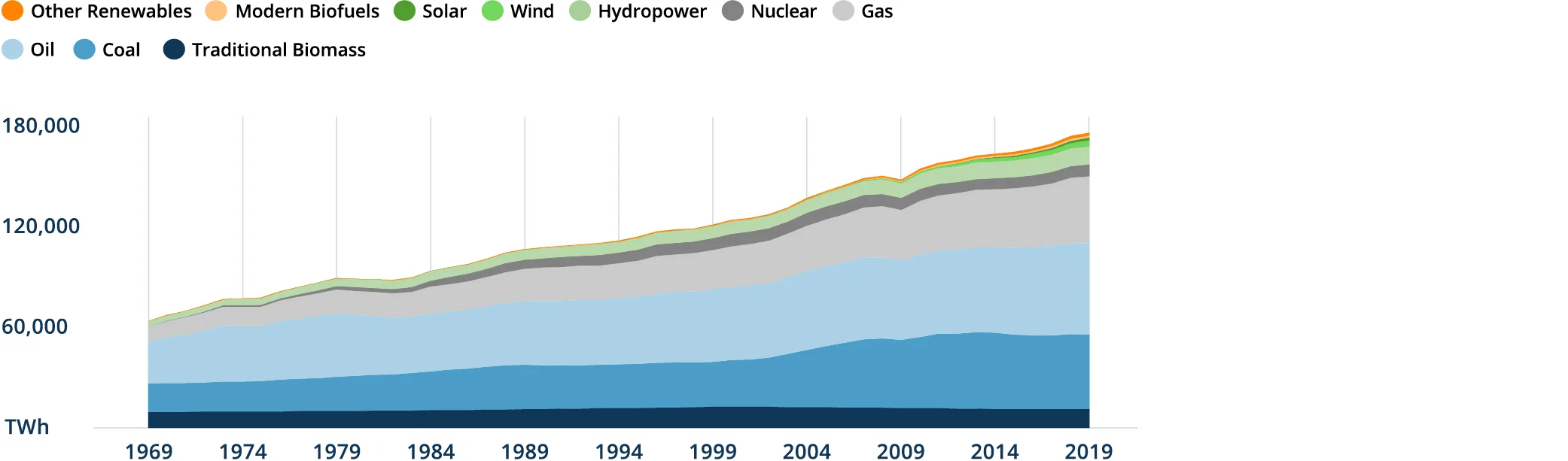

We recognize that further renewable power capacity must be rapidly scaled to replace fossil fuel generation and to meet expanding global electricity demand

so that the world can eliminate the more than 70% of global emissions that come from final energy consumption as quickly as possible.

Rift Alliance intends to build on this leading position in renewable power and do much more to contribute to the transition to net zero:

We will go further

In addition to continuing to make major investments in renewable energy globally, we will manage our investments to be consistent with the transition to a net zero economy. As a recent signatory to the Net Zero Asset Managers initiative, we have made a commitment to investing aligned with net zero emissions by 2050 and implementation of science-based approaches and standardized methodologies through which to deliver these commitments.

We will help accelerate the transition to Net Zero

We will catalyze companies onto Paris-aligned net zero pathways through our new Global Transition investment strategy, focusing specifically on investments that will accelerate the transition to a net zero carbon economy.

We will collaborate

We will work with leading private sector initiatives to advance the role of finance

in supporting the economy-wide transition, to accelerate capital flows consistent with the Paris Agreement, and to promote widespread adoption of decision-useful methodologies to support credible transition planning, analysis and investing.

We are committed to transparency

- We will track and report GHG emissions consistent with GHG Protocol and PCAF standards.

- We will publish decarbonization plans every five years consistent with the Paris Agreement.

- We continue to align our business with the TCFD recommendations

and are targeting to incorporate TCFD disclosures for the 2022 fiscal year.We will continue to pursue industry-leading returnsWe will continue to pursue industry-leading returns for our investors, consistent with our long track record of building the backbone of a more sustainable global economy.

Electric Utilities

Given its reliance on fossil fuels to meet energy demand, the power generation sector is responsible for an outsized portion of global greenhouse gas emissions.

Massive investment, therefore, will be required to transition the power sector. According to a report co-authored by Boston Consulting Group (BCG) and the Global Financial Markets Association (GFMA), an estimated investment of over $50 trillion will be needed globally over the next three decades to increase renewables capacity and improve grid flexibility and reliability.

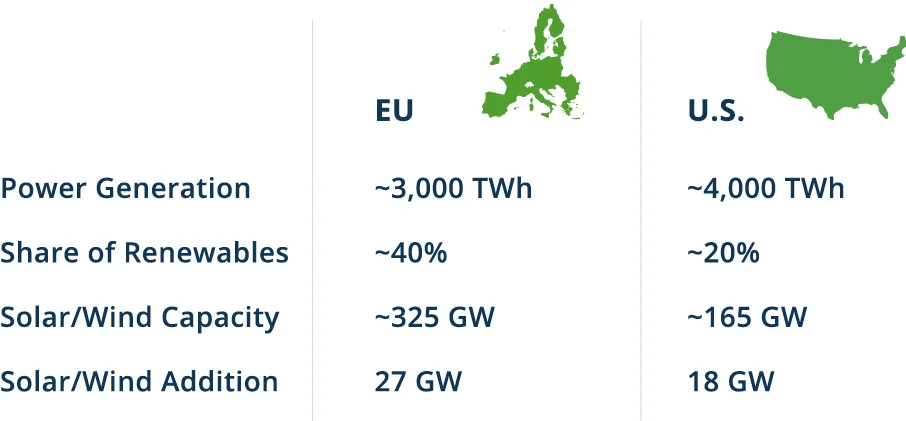

Europe Outpaces the U.S. in Renewables

In other words, it’s an opportunity for private capital to participate in the decarbonization of electricity grids. The shift is fueled by a push to reduce GHG emissions to meet increasingly stringent carbon reduction targets. In the U.S., for example, some states have legislated requirements for electric and gas utilities to reach a net-zero goal. Moreover, renewable portfolio standards, which are policies designed to increase the use of renewable energy sources for electricity generation, have now been adopted by over 60% of U.S. states. Yet, relative to Europe, the U.S. still has work to do; the EU’s new 2030 climate target plan will further accelerate the deployment of renewables.

Markets are also increasingly rewarding businesses that are decarbonized or are on a pathway to meeting net-zero targets through valuation premiums and reductions in the cost of capital. For example, RWE, one of Germany’s largest utilities, transformed itself into Europe’s third-largest renewables player following a 2019 asset swap with E.ON. RWE’s decision to increase its renewable power assets, made in tandem with its plan to eliminate coal, set the business on a net-zero path. Subsequently, RWE’s valuation metrics improved.

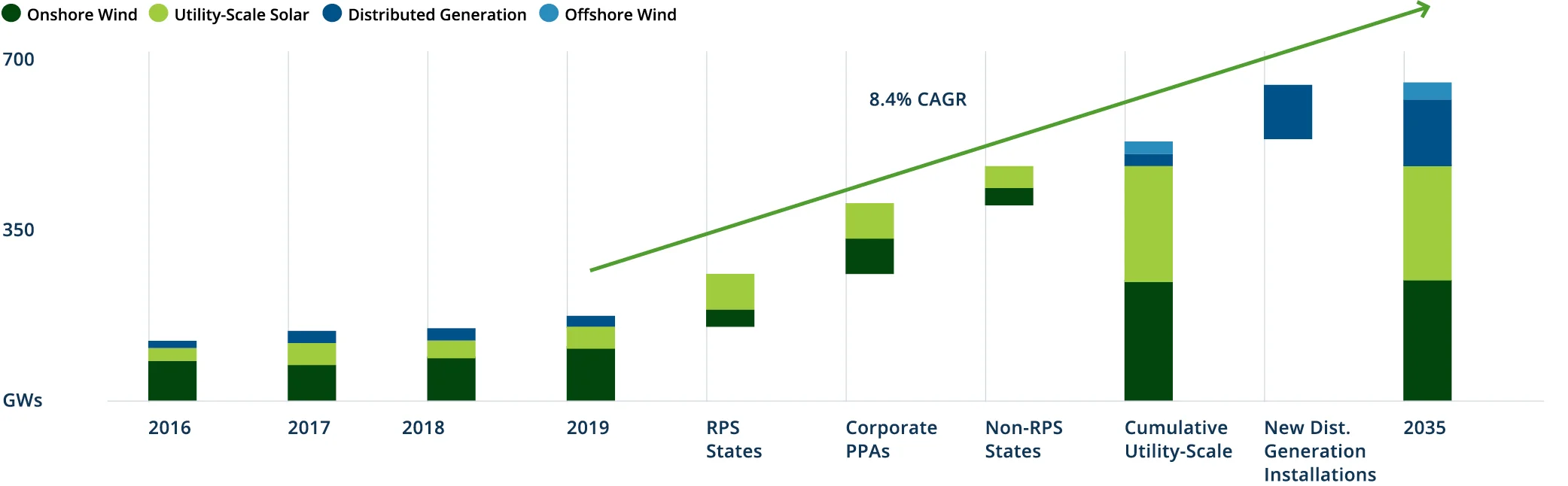

A successful transition relies on power and utility companies transforming their generation mix to significantly favor renewables or low-carbon energy production. In the U.S., Rift Alliance forecasts wind and solar power capacity additions of 463 GW by 2035; this would represent a 262% increase in capacity from 2019 levels. Some of these companies have the capital and skills to do it themselves, but many do not.

Renewables Are Projected to Grow in the U.S.

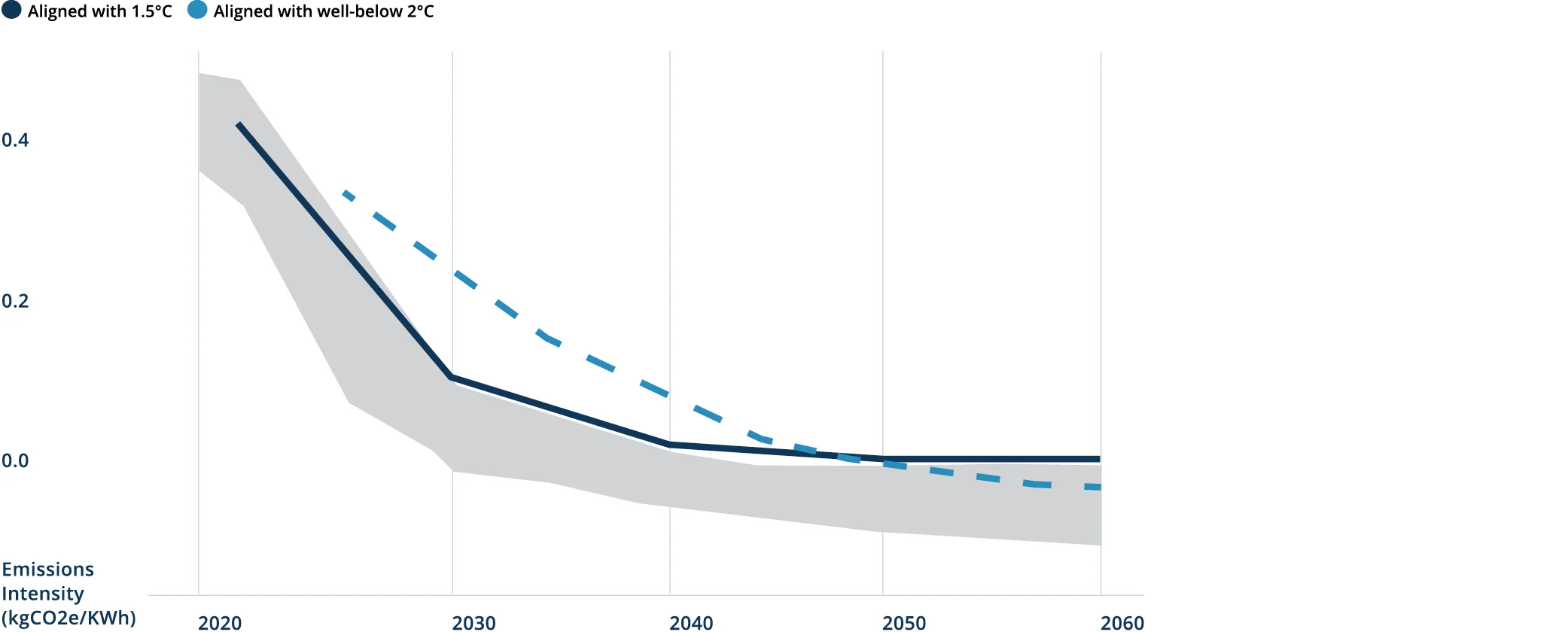

Utilities will need to lower emissions consistent with country emission reduction strategies, such as the Biden administration’s aggressive goal for the U.S. power grid to achieve 100% carbon-free electricity by 2035. Yet, as the path to 1.5°C is not linear, companies that generate power—and that also set targets consistent with the pathways recommended by the Science Based Targets initiative’s (SBTi) sectoral decarbonization approach (SDA)—need to reduce emissions rapidly over the next decade relative to their historical levels.

Utilities with more coal in their power generation stack, therefore, have more work to do. These utilities need to get off coal—and then transition to anything else. As one example, they might transition from coal to gas—and eventually to renewables once they are able to store that energy for deployment around the clock.

Transitioning from coal to gas, however, is not a simple process. The utility will need to build a pipe to transport the gas to its facility—it also will need to re-line the boilers and bring new gas turbines in, work with a systems provider to help procure a long-term gas agreement, and measure and monitor its CO2. Those are all complex challenges, and they come at a cost. Determining that cost and identifying who can help with the transition are necessary additional steps.

And yet, along the net-zero continuum, converting from coal to gas only takes the utility halfway there. Utilities are looking to grow their renewables footprint, but they must also factor in how regulators will view their capital plans.

Utilities Need to Reduce Emissions Quickly

For a U.S. utility that generally operates under traditional rate base/rate of return regulation, the next questions that follow are: Will the regulator allow that utility to recover the cost of new generation investments from ratepayers? Will the regulator let the utility use ratepayer money to figure out how to decarbonize? Or would it reject that capital plan, fearing cost overruns?

The more attractive solution might be to have an experienced third-party company bear that risk. Not only does this leave taxpayers out of the equation, it comes with other clear advantages. These types of operators often already have deep relationships with original equipment manufacturers (OEMs)—companies like GE and Siemens that not only build equipment like generators and turbines, but then put them to work. These relationships can help smooth the process of coming to a commercial agreement and solving any problems along the way.

Of course, some power users will not want to wait. Those with large Scope 2 emissions will seek more distributed generation with dedicated renewables capacity. Meanwhile, providers that can offer solutions in multiple geographies will likely earn a premium.

Technology Companies

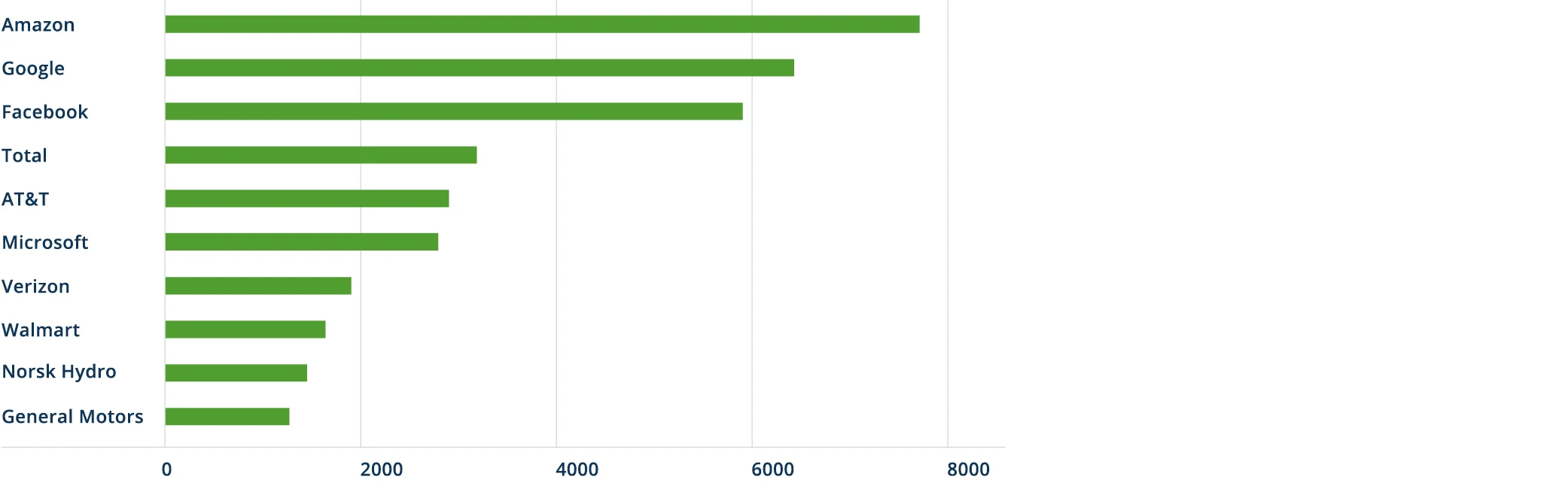

Tech companies like Amazon, Google, Microsoft, Facebook and Apple are quickly becoming some of the largest consumers of electricity. These companies need large amounts of power to run their servers and keep them cool. Given the computing power necessary to satisfy the rise of cloud computing, artificial intelligence and machine learning, this amount will continue to grow.

Data centers run on huge amounts of energy—which makes the biggest technology companies major buyers of clean power. These counterparties are looking to achieve their own decarbonization goals, and they want solutions providers that can help—specifically, by taking them off the brown grid and putting them on the green grid.

This has led to the rise of green data centers, which run on carbon-free electricity from hydropower, wind and solar. Microsoft and Google have committed to shift to 100% renewable energy supply for their data centers by 2025 and 2030, respectively. To get there, these counterparties must enter into green power purchase agreements (PPAs). These agreements define all the commercial terms for the sale of electricity—in this case, it’s between the tech company, who is buying power, and a seller, who is generating that power.

New development of clean energy generation can also be required—this is the concept of “additionality.” Here, the contract supports the funding and buildout of a new renewables development, thereby increasing clean energy capacity—making the contract the catalyst for a positive impact.

Tech companies are looking for a solutions provider that can help them with decentralized power production, green PPAs and other requirements. In Ireland, for example, new wind projects are underway that will be tied to PPAs that will ultimately power Facebook and Amazon data centers.

Partnering with the largest technology companies means that solutions providers need to be on the leading edge of where the market wants to go—and how the electricity grid is transforming.

Heavy Industries

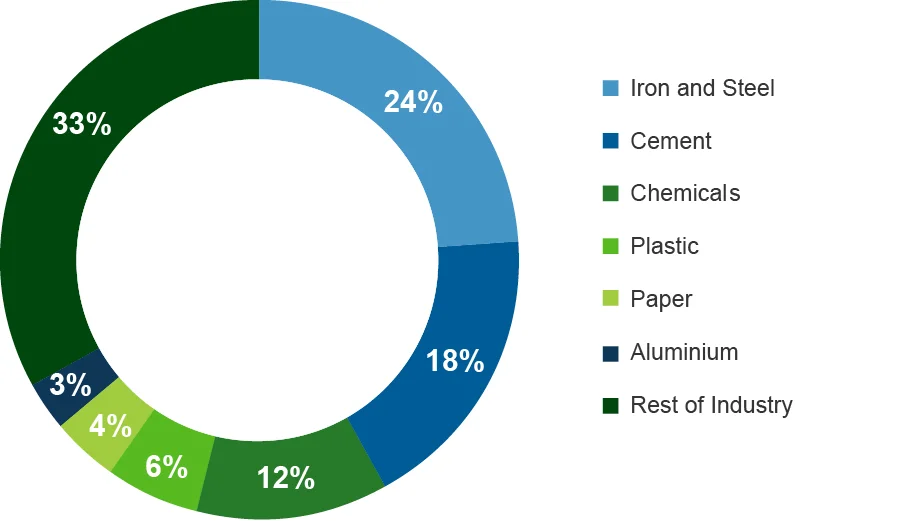

To some extent, the opportunity set to transform businesses is simply where the emissions are. With that in mind, heavy industries, like steel, cement and long-haul trucking, are ripe for transition.

Opportunities to Decarbonize Heavy Industries

Steel

Steel is vital in modern economies. It’s used in the construction of buildings, bridges, cars, trucks and wind turbines. Global demand for steel has increased more than threefold over the past 50 years—and will continue to rise as economies grow, urbanize and enhance their infrastructure.

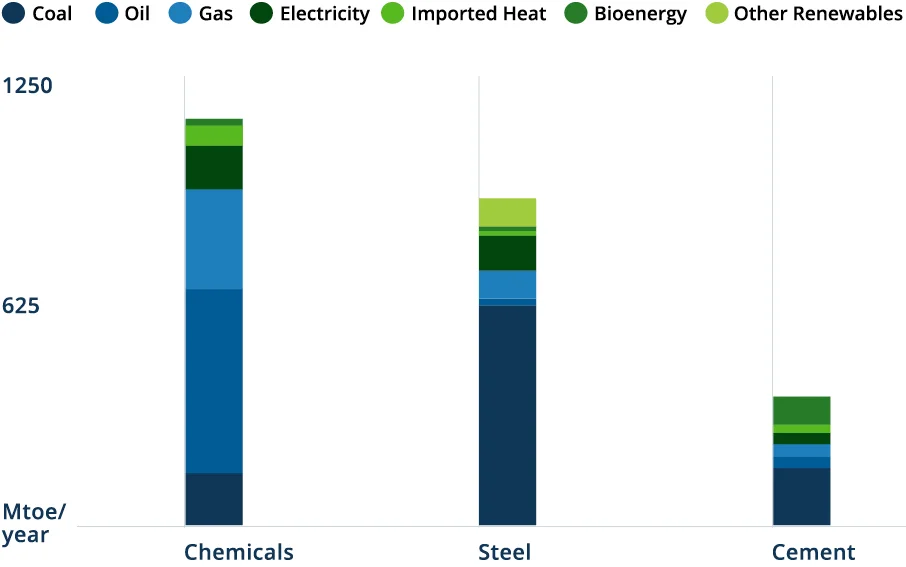

According to the International Energy Association (IEA), the iron and steel sector is responsible for about 8% of final global energy demand and 7% of energy sector CO2 emissions (including process emissions).17 Among heavy industries, the iron and steel sector consumes more energy than any other sector besides chemicals (see Figure 6a). But the issue—and opportunity—is around its use of coal. This is because the steel sector is the largest industrial consumer of coal; in fact, coal provides almost 75% of the steel sector’s energy demand.

Coal is used to generate heat and to make coke—and coke is the fuel instrumental in the chemical reactions needed to produce steel from iron ore in blast furnaces. However, the unavoidable byproduct of these reactions is carbon dioxide.

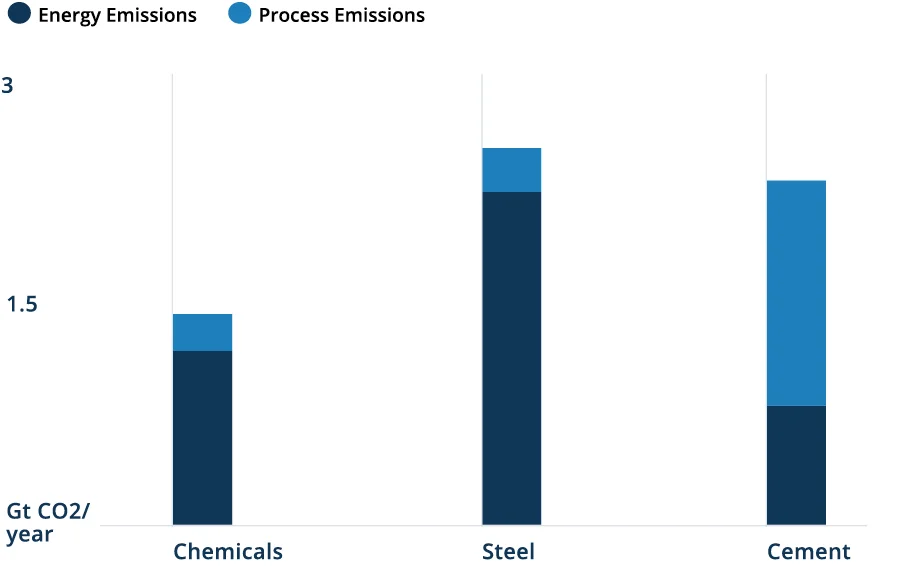

Surveying the landscape of heavy industries, when it comes to CO2 emissions, the iron and steel sector comes in first, generating 2.6 gigatons of carbon dioxide (Gt CO2) emissions annually.

Renewables Are Projected to Grow in the U.S.

Steel’s Energy Emissions Are High

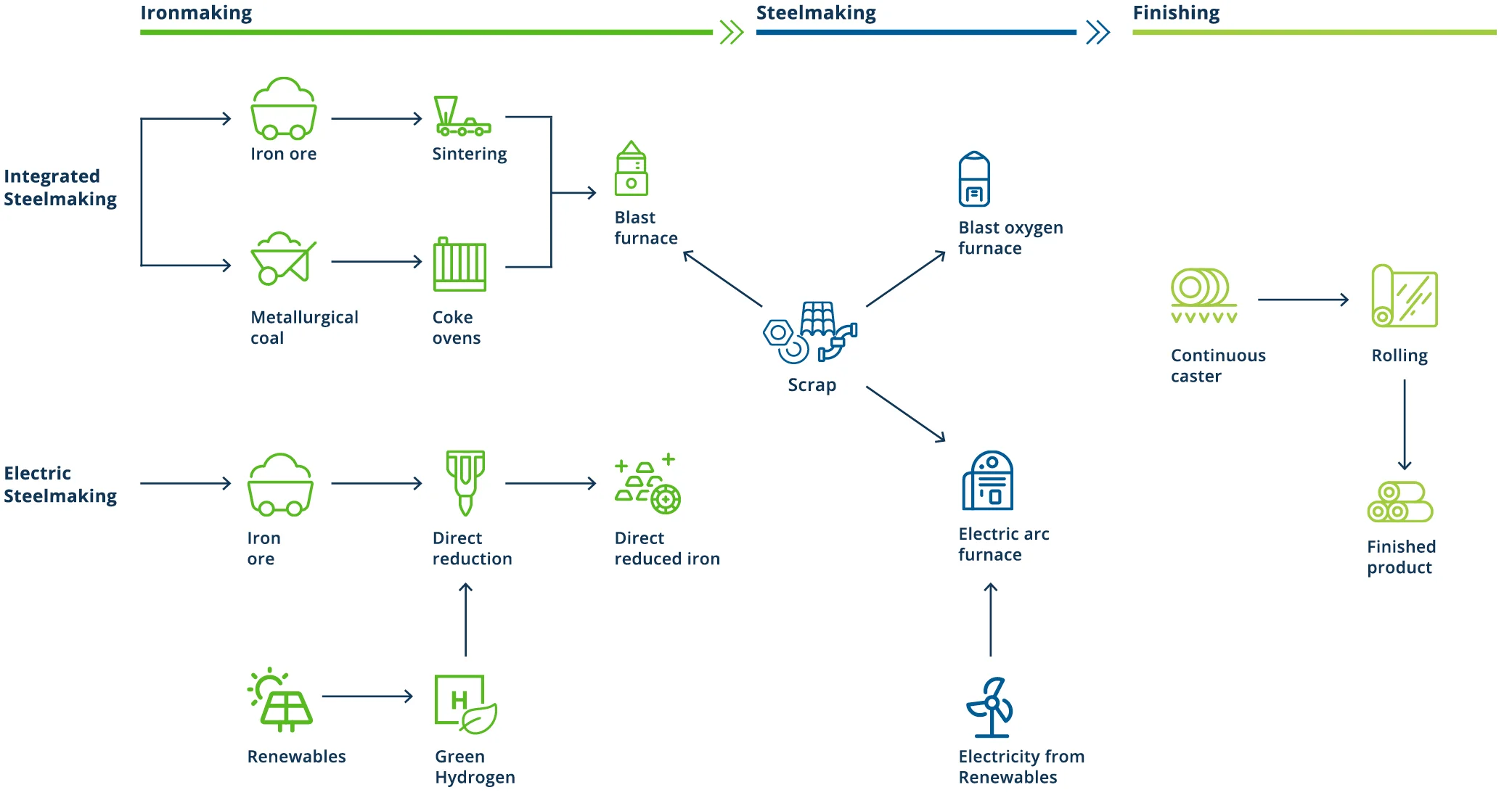

But heavy industry sectors are generally considered hard to abate for a reason. Consider the two main process routes for how steel is manufactured today: integrated steelmaking and electric steelmaking. From a carbon-emitting perspective, the electric route is preferred over integrated steelmaking. Average emissions of CO2 per ton of steel are dramatically less—0.5 tons of CO2 using scrap metal, versus 1.8 tons of CO2 using iron ore. Yet steelmakers can’t simply increase their share of electric steelmaking because cost is a major issue, as the large installed base is incredibly expensive to change. Also, the necessary scrap metal is in finite supply, and that supply falls short of global needs.

The opportunity to transition, especially for European steelmakers, is with a new process that creates “green” steel. Produced with an electric arc furnace, this is steel that uses DRI as the feedstock, but it’s produced with hydrogen that is powered by renewable energy. While costs are currently too high to be competitive, “green” steel would eliminate most CO2 emissions.

The thesis around the decarbonization of steel, in simple terms, can therefore be thought of in two steps. The first step is the switch from blast furnaces to electric arc furnaces. Not only is significant capital necessary here, but so is knowing how supply chains can be reconfigured. The second step involves using green power to support electric arc furnaces, as well as having green power and hydrogen support the DRI process. For both, knowledge of how to scale up hydrogen and renewable power projects is required.

Note that under this hydrogen route, energy demand could materially increase over the next three decades. Therefore, the transition to EAFs will materially increase demand for renewable energy. Fortunately, renewables are already cost-effective.

Decarbonizing Steel Requires More Electric Steelmaking—and More Renewables

Cement

Cement is essential, but it’s also highly carbon intensive. The industrial process that yields cement accounts for 8% of global greenhouse-gas emissions. In fact, if cement were a country, it would be the world’s third-largest emitter, behind China and the U.S. But what if the cement-making process evolved over the next decade such that the carbon emitted precipitously dropped?

The implementation of carbon capture and storage (CCS) is one possible solution. CCS is the process of capturing CO2 formed during power generation and industrial processes—and storing it so that it’s not emitted into the atmosphere. While carbon capture technologies are already used in various industrial processes, they could also apply to cement. HeidelbergCement, for example, is building an industrial-scale CCS plant in Brevik, Norway. When the facility is finished in 2024, the end result will be a 50% cut in emissions from the cement produced at that plant.

Transportation

Emissions in the transportation sector—which accounts for 16% of the energy sector’s GHG emissions—come from the use of internal combustion vehicles powered by fossil fuels. But the decarbonization pathway differs depending on the type of vehicle. For short-haul vehicles, the solution is to replace the fleet with electric vehicles. For long-haul transportation, like trucking and aviation, it will require the use of green hydrogen or biofuels.

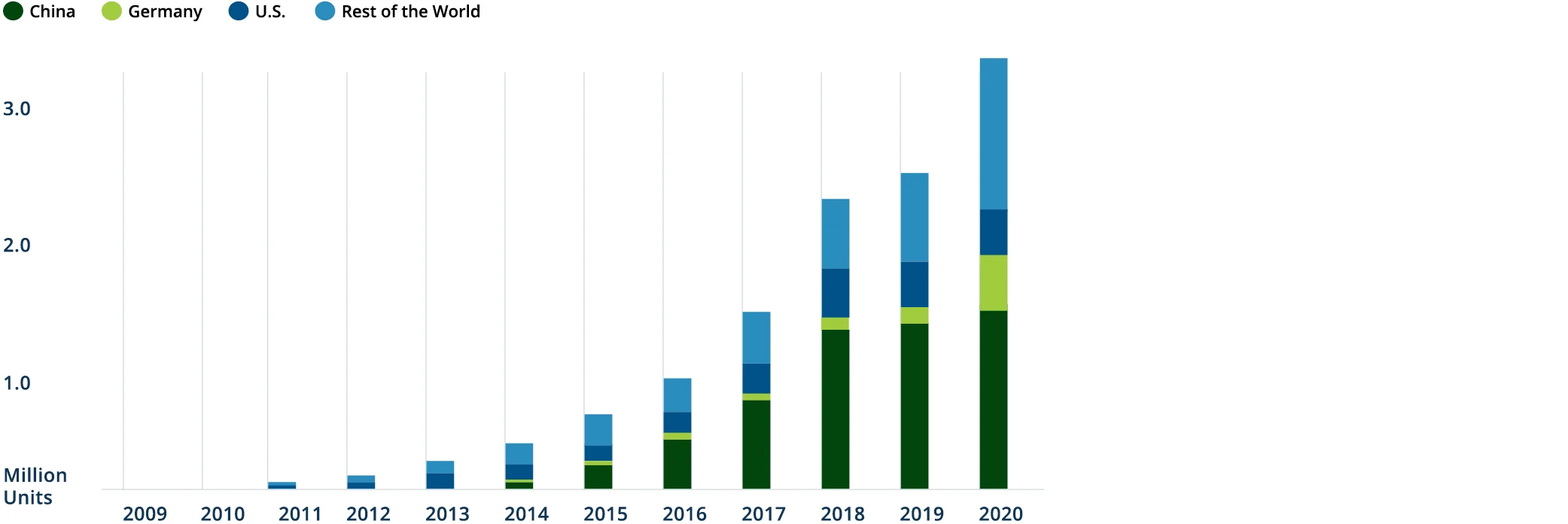

For short-haul vehicles, the trends are already moving in the right direction. Governments are implementing climate-friendly policies to drive business transformation. The U.K.’s pledge to phase out all sales of cars using only petrol or diesel by 2030 is a strong example. In February 2021, Ford declared that it will stop selling cars in the U.K. and Europe with any form of internal combustion engine by 2030.

Competitive realities, as well as broader consumer acceptance of electric vehicles, are also spurring progress. General Motors announced its plans to get out of the internal combustion game—and sell only zero-emission cars and trucks by 2035. Volvo has said it would be all-electric by 2030. Meanwhile, Volkswagen plans to sell 1 million electric or hybrid cars this year—a near-tenfold increase since 2019.

Decarbonizing Steel Requires More Electric Steelmaking—and More Renewables

Not only will the electrification of the auto sector continue, but so will the decarbonization of the electricity that powers that now-electrified sector. Both are required for the transition to net zero.

While electric vehicles excel at short-haul travel, more infrastructure, such as charging stations, will need to be built up—and this is another area where private capital can help.

Breakthroughs continue to be made in battery technology, but electrification likely will not be the solution for long-haul vehicles, like 18-wheelers. In the U.S., much of the nation’s freight is delivered via medium- and heavy-duty trucks. These vehicles account for more than 20% of the freight industry’s greenhouse gas emissions even though, in the U.S., they make up less than 5% of the road fleet.

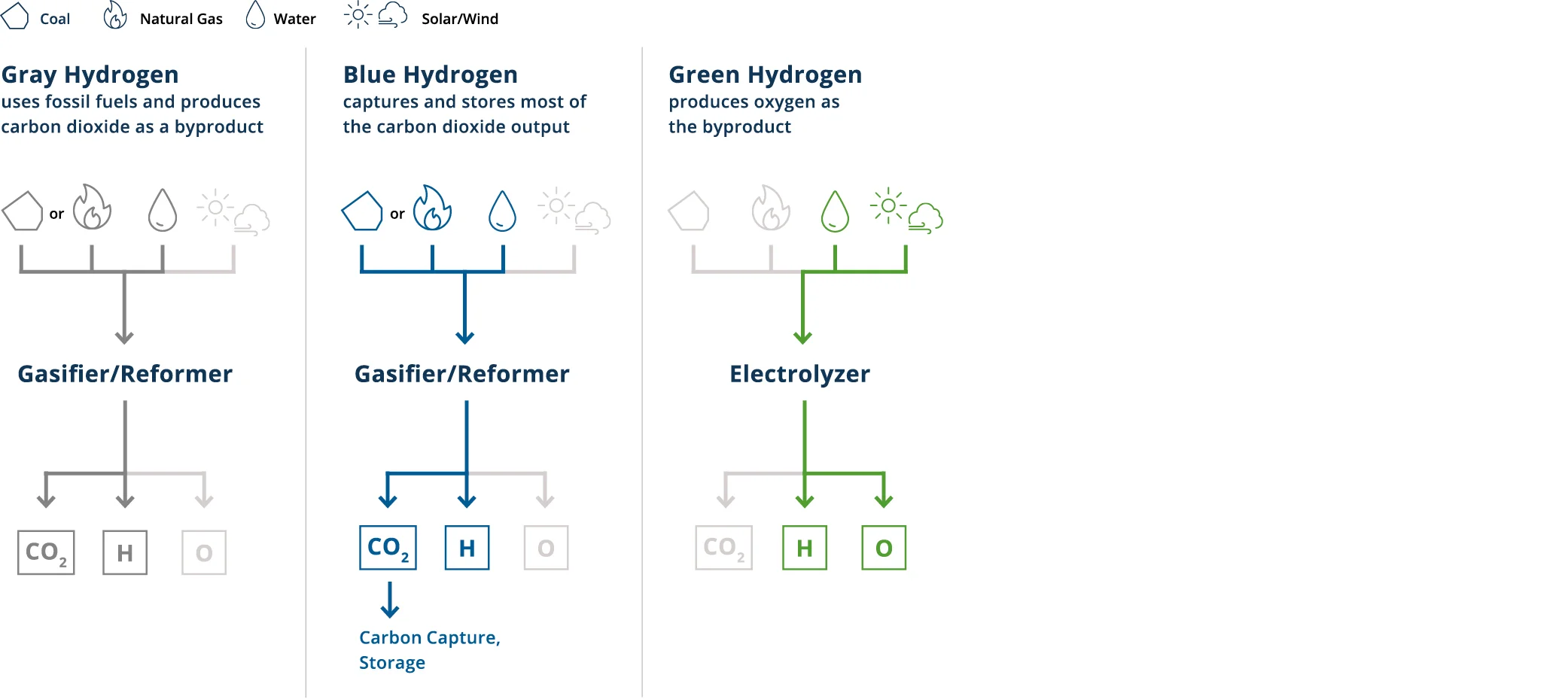

Eventually, green hydrogen could be used in long-haul freight and trucking. Because these modes of heavy transport are difficult to electrify, many will still have to run on gas. And since green hydrogen is a completely clean form of energy, it offers a path to the global goal of decarbonization.

Green Hydrogen Is a Completely Clean Form of Energy

Oil & gas

Oil & gas companies will need to transition their businesses to a lower-carbon future. According to the IEA, 15% of global energy-related GHG emissions come from the process of extracting oil and gas from the ground and transporting it to consumers. However, this figure doesn’t include Scope 3 emissions, which will thus lead to a step change in how oil & gas companies think about the transition.

Energy majors have been among the most innovative companies of the last century; as evidence, consider the recent shale gas revolution. They will have to use this expertise to reposition themselves to become the producers of carbon-free power generation that will support the next century. First, they need to decarbonize the production and transportation of fossil fuel energy as much as possible. And second, to maximize the returns on their existing assets, they’ll need to develop lower carbon solutions that include CCS and hydrogen.

Therefore, the opportunity here is to help these companies quickly invest in what might be non-core today but will be core in the future. BP, for example, plans on cutting its fossil fuels production by 40% by 2030, and will simultaneously increase spending on low-carbon technologies. The net effect of these efforts could be a 30% reduction in BP’s greenhouse gas emissions.

Yet, for carbon-emitting companies that cannot adapt, the net effect of carbon prices will be declining margins, thus pressuring cash flow and impacting the value of their businesses.

Capital markets, of course, have already taken notice. Over the past decade, the market capitalizations of some oil & gas supermajors have drifted lower.

To be clear, oil is not going away any time soon. Therefore, finding ways to reduce the amount of carbon the oil & gas industry emits into the atmosphere is part of the solution. Companies are beginning to understand that decarbonizing their businesses is part of their value proposition to investors. But many of these businesses need a partner with experience to help them put a net-zero plan in place—so they can start their decarbonization journey.

It is likely these oil & gas companies will be incentivized to participate with a solutions provider, and share in the economics, because they want to protect, or enhance, the long-term value of their existing franchise.

But importantly, once oil & gas companies see a way to deliver their products in a decarbonized manner, in scale, they will see the benefit in investing in technologies that might be slightly uneconomic today—like CCS or green hydrogen—because it gives them a viable path to realizing value from their existing assets over a longer period of time.

Rift Alliance, in its base case, forecasts that energy, together with chemicals and power, addresses a $225 billion market globally for CCS in 2050. Among global CCS capacity, Rift Alliance notes that approximately 50% is in the U.S. Much of this is synergistic with existing businesses—captured through natural gas processing and sequestered in enhanced oil recovery.

Furthermore, as oil & gas companies look to “green up” their business for the energy transition, their midstream assets could be converted into critical infrastructure of new technologies. However, the commercialization of a technology like carbon capture and storage will require both significant capital and a drop in cost.

In the shorter term, the transition will be weighted toward renewables. But as other technologies prove themselves out and grind their way down the cost curve, the business transformation theme will move beyond renewables to these other technologies. Forward-thinking policies like carbon taxes will help accelerate that process.

Real Estate

Lastly, real estate will also need to transform—especially since 18% of energy sector emissions come from buildings.

Sustainability can be incorporated into every stage of a building’s life span, from initial planning through end-of-life operation. For buildings to “go green,” energy reduction must be one of the key initiatives. Areas for investment include distributed generation, smart meters, HVAC (heating, ventilation, and air conditioning), district energy, boiler electrification and building management systems. Furthermore, with more customers seeking environmentally friendly products, sustainable building materials are another area of investment.

According to the U.S. Energy Information Administration, HVAC represents the largest source of GHG emissions within the average commercial and residential building. And given that HVAC systems are large users of energy, partnership opportunities should arise from the transition to net zero.

District energy systems are also attracting interest, as they provide a more sustainable way of heating and cooling buildings. In fact, cities like Toronto, Chicago, Houston and Paris are already using the district energy concept to reduce their energy use—and carbon emissions. District energy systems are increasingly climate resilient, and they can help cities reduce their primary energy consumption for heating and cooling by up to 50%.

Conclusion

In 2021, according to the IEA, global energy-related CO2 emissions are on course for their second-largest annual increase ever—reversing most of last year’s decline caused by the Covid-19 pandemic. Clearly, the time for all of us to act is now.

Effective, credible public policy provides the foundation for addressing climate change. It can incentivize companies to take more aggressive action to reduce their carbon footprint. But while the will to transition their business might be there, the way is often unclear. Private capital and operational expertise can assist in many ways—in transitioning power generation portfolios to green capacity, in electrifying the operating processes of heavy industries, and in developing and supporting new technology and related infrastructure. Putting it all together, it’s an opportunity to create real value.