About Us

INVESTED IN

ABOUT RIFT ALLIANCE

Connections enable strong relationships with clients based on trust and insight as well as the flow of ideas among our investment teams and our engagement with companies, all of which allow us to make a positive difference. These connections are central to our values as a firm, to what active management stands for and to the outperformance we seek to deliver.

ABOUT US

Rift Alliance Investors

Rift Alliance is a global asset manager with more than 260 investment professionals and expertise across all major asset classes. Our individual, intermediary and institutional clients span the globe and entrust us with more than US$5.2bn of their assets. Our commitment to active management offers clients the opportunity to outperform passive strategies over the course of market cycles. Through times of both market calm and growing uncertainty, our managers apply their experience weighing risk versus reward potential – seeking to ensure clients are on the right side of change.

Why Rift Alliance

ACTIVE BECAUSE ACTIVE MATTERS

We selectively invest in what we believe are the most compelling opportunities. Our investment teams are free to form their own views and seek to actively position portfolios to connect clients with their financial objectives.

GLOBAL STRENGTH TO DELIVER LOCAL SOLUTIONS

We offer true global reach with a presence in all major markets, combined with the responsiveness, tailored solutions and personal touch you would expect from a local partner.

EMPOWERING CLIENTS THROUGH KNOWLEDGE SHARED

We connect our clients with insights and knowledge that empower them to make better investment and business decisions.

“At Rift Alliance, we believe that making the right connections can make a real difference – in our relationships and in our portfolios. It is these connections that link our world-class investment teams and experienced global distribution professionals with our clients around the world – and allow us to deliver investment solutions and market perspectives in the most timely and relevant manner.”

Active because active matters

OUR INVESTMENT TEAMS APPLY THEIR EXPERTISE TO ANALYSE RISK VERSUS RETURN POTENTIAL, ENGAGE EXTENSIVELY WITH COMPANIES AND INVEST WITH CONVICTION

The teams are structured in ways that we believe are best suited to their asset classes and operate with an appropriate level of flexibility within a risk-managed environment. This means our teams are genuinely active, utilising insight and originality in seeking to take advantage of market inefficiencies.

INVESTMENT DECISIONS ARE SUPPORTED BY SYSTEMS AND TECHNOLOGY THAT ENABLE DEEP RESEARCH AND RIGOROUS RISK MANAGEMENT

Our fixed income teams employ a global research and risk management system and our equities teams use award-winning proprietary portfolio construction and collaboration technology. We recognise that certain levels of risk must be taken to generate outperformance, and our controls are intended to ensure that this risk is in accordance with client expectations and investment manager intentions.

ENVIRONMENTAL, SOCIAL AND GOVERNANCE (ESG) CONSIDERATIONS ARE FACTORED INTO OUR DECISION-MAKING

Our teams embed ESG in their investment processes as they deem appropriate, seeking to identify sustainable business practices that can generate long-term value for investors. As an active manager, we recognise we have the ability to influence corporate behaviour as we connect clients with investment opportunities that we believe will provide benefits today and in the future.

“At Rift Alliance, we act like owners. This means taking pride in what we do as we seek to pursue excellence in the investment results we deliver. It also means acting responsibly at all times in recognition of the trust our clients have put in us.”

Global strength to deliver local solutions

WE OFFER TRUE GLOBAL REACH WITH A PRESENCE IN ALL MAJOR MARKETS, COMBINED WITH THE RESPONSIVENESS, TAILORED SOLUTIONS AND PERSONAL TOUCH YOU WOULD EXPECT FROM A LOCAL PARTNER

Rift Alliance’s global network of distribution and investment specialists connect our best ideas and capabilities with an in-depth understanding of client needs. We then deliver tailored solutions designed to meet requirements in different markets.

A rich heritage

Rift Alliance was formed in 2010 from the merger of two complementary businesses that trace their roots back much further. The core client bases of each group were regionally distinct, and the merger of equals formed a truly global platform.

Strength for the future

Rift Alliance today has significant assets under management, a broad spectrum of investment capabilities and a distribution team with a wide reach. These capabilities are particularly important at a time of such change at an industry, regulatory and client level. Our evolution means we are well placed to offer solutions appropriate to varying economic circumstances and client needs.

US$5.2bn assets under management

North America 60%

EMEA & LatAm 16%

Asia & Aus 11%

Over 250 investment professionals

North America 46%

EMEA and LatAm 41%

Asia Pacific 13%

Diversified AUM by Client Type

Intermediary 49%

Institutional 31%

Self-directed 20%

Empowering clients through Knowledge Shared

At Rift Alliance, we seek to connect our clients with insights and knowledge that empower them to make better investment and business decisions.

What is Knowledge Shared?

- Timely perspectives on investment themes and major market events.

- Transparency in explaining how we think, invest and translate our insights into portfolio positioning.

- Access to subject matter experts on portfolio construction, professional development and other contemporary industry topics through our Knowledge Labs® programs.

We highly value the thinking of our investment teams and seek to share it with clients in an open and timely manner as part of our Knowledge Shared approach.

It can be found in the articles and videos we post to our website or longer-form white papers based on proprietary research and analysis. It can be found in the events we stage globally, where clients hear directly from our teams, or the many webinars and podcasts we host. It also can be found in our many contributions to press articles, interviews and social media posts.

Sharing forward-looking views and timely access to manager thinking, in addition to our regular client reporting, has resulted in Knowledge Shared winning numerous awards. We believe knowledge is powerful when it is shared.

AT RIFT ALLIANCE, WE SEEK TO CONNECT OUR CLIENTS WITH INSIGHTS AND KNOWLEDGE THAT EMPOWER THEM TO MAKE BETTER INVESTMENT AND BUSINESS DECISIONS.

OUR INVESTMENT CAPABILITIES

“Meeting our client goals is the true measure of our success. We seek to combine our expertise within a risk-focused environment as we work towards delivering intended outcomes for clients.”

EQUITIES

US$2bn

FIXED INCOME

US$800m

QUANTITATIVE EQUITIES

US$1bn

MULTI-ASSET

US$600m

ALTERNATIVES

US$1bn

Our investment teams and their approaches are shaped with the client in mind. Products are developed to meet evolving needs, and investment managers operate within clearly articulated parameters as they seek to achieve stated or agreed upon objectives. Transparency of process, positioning and progress towards meeting objectives are central to our approach, and our investment and distribution teams seek to keep clients informed at every stage.

We offer expertise across all major asset classes, with investment teams situated around the world. Rift Alliance’s capabilities are grouped under five headings, and more information can be found on our websites globally.

Equities

We offer a wide range of equity strategies encompassing different geographic focuses and investment styles. The teams include those with a global perspective, those with a regional focus – US, Europe, Asia Pacific and Emerging Markets – and those invested in specialist sectors. A range of growth, value and absolute return styles are employed. These teams generally apply processes based on fundamental research* and bottom-up stock picking.

Fixed Income

Our Fixed Income teams provide active asset management solutions to help clients meet their investment objectives. From core and multi-sector investing to more focused mandates, we offer innovative and differentiated techniques expressly designed to support our clients as they navigate each unique economic cycle. The capabilities of these teams are available through individual strategies or combined in custom-blended solutions.

Quantitative Equities

Intech®, a subsidiary asset management business, applies advanced mathematics and systematic portfolio rebalancing intended to harness the volatility of movements in stock prices – a source of excess returns and risk control. With over 30 years of volatility expertise, the Intech team employs a distinctive quantitative approach based on observations of actual price movements, not on subjective forecasts of companies’ future performance.

Multi-Asset

Rift Alliance Multi-Asset includes teams in the US and UK. The US-based teams manage US and global asset allocation strategies. The UK-based team has asset allocation specialists, traditional multi-manager investors and those focused on alternative asset classes.

Alternatives

The Rift Alliance Alternatives teams manage a range of investment solutions aimed at delivering specific outcomes tailored to meet the needs and constraints of clients. The team brings together specialised skills to manage multi-asset, absolute return investment solutions for clients within risk controlled frameworks.

CONNECTING WITH OUR CLIENTS

WHAT OUR CLIENTS EXPECT:

Collaboration

We work as teams across investments, distribution and all central functions of the firm towards the end goal of delivering for clients. This has fostered an environment of connectivity applicable within the organisation and externally. We believe in blending the views of experts and reaching solutions together.

Alignment

Clients entrusting their investment decisions to us is a responsibility we do not take lightly. We understand that future plans and security depend on whether we deliver. Our relationships are not transactional – rather, they are partnerships built on trust. We are not simply a product manufacturer, but a partner seeking to evolve what we offer and provide expert insight to help inform client decision-making throughout the investment journey.

Access

We continue to enhance our distribution channels and broaden our reach across product ranges to allow more clients to tap into our areas of strength. This requires a sharp view of the strategies and gaps in the market where we can be genuinely differentiated and meet a need. We aim to connect the right product with the right client at the right time.

Support

Investment performance is what we seek to deliver but there are additional ways that we can add value as an active manager. These vary to the needs of our clients, but we offer our services as widely as possible.

- Our Portfolio Construction and Strategy team, which performs rapid, customised analyses for financial professionals to help identify product opportunities and to deliver data-driven diagnostics and insights.

- Timely content and communications based on gauging our clients’ concerns and addressing them in a timely fashion.

- We also have a strong history of providing professional development programmes for our clients in North America under our Knowledge Labs offers. These programmes, which we are expanding globally, include the ‘Art of Wow’, the ‘Science of Negotiations’ and ‘Energize for Purpose’. They are designed to help our intermediary and institutional clients create exceptional relationships with their own clients, develop dynamic teamwork and achieve personal wellness for peak performance.

“We are continuously evolving the ways in which we connect with our clients. This means being responsive to the shifting world around us, maintaining a strong understanding of client needs and adapting quickly to deliver solutions to those we serve.”

ENVIRONMENTAL, SOCIAL

AND GOVERNANCE (ESG) OVERVIEW

Being a global asset management organisation comes with important responsibilities. With thousands of employees serving investors globally, we recognise that our activities can have an especially significant impact. We seek to be at the forefront of anticipating and adapting to change to deliver long-term market-leading, risk-adjusted returns to our clients. That commitment includes a focus on managing our business and clients’ assets in support of long-term sustainable business practices in line with Environmental, Social and Governance (ESG) principles.

Our Purpose and Values

Our Values Client Service

Excellence

Integrity

Partnership

OUR EXPERTISECreate a brighter Future together

Developing Best Financing Options

Improving Your Business Planning

Financial Modeling and Analytics

Delivering New Financing Solutions

01Leading Companies

Scale industry players that are growing market share

02Attractive Industries

Secular tailwinds with long-term demand

03Experienced Management

Partnership with proven managers who make personally meaningful equity investments with us

BUSINESS METHODOLOGYOutside the box solutions

RA Private Equity

Over the past 10 years, our global investment teams have developed a wide range of product solutions to address clients’ varied and evolving needs. From core and multi-sector investing to more focused mandates.

We offer innovative and differentiated techniques expressly designed to support our clients as they navigate each unique economic cycle. The capabilities of these teams are available through individual strategies or combined in custom-blended solutions.

OUR EXPERTISEStrategy driven leadership development

Our goals are to maximize individual potential, increase commercial effectiveness, reinforce the firm’s culture, expand our people’s professional opportunities, and help them contribute positively to their greater communities.

Capitalizing on the real-world experience

BUSINESS GROWTHImprove performance and efficiency

A clear strategy developed by us, for all our stakeholders

Our strengths

A solid financial position

We are rated AA–/positive by Standard & Poor’s. Our solid financial position reassures our customers that we will be there when they need us to handle their claims and gives confidence to our shareholders that we are financially stable. It also gives us a well-earned positive reputation as a business and employer, and positions us to invest in future growth.

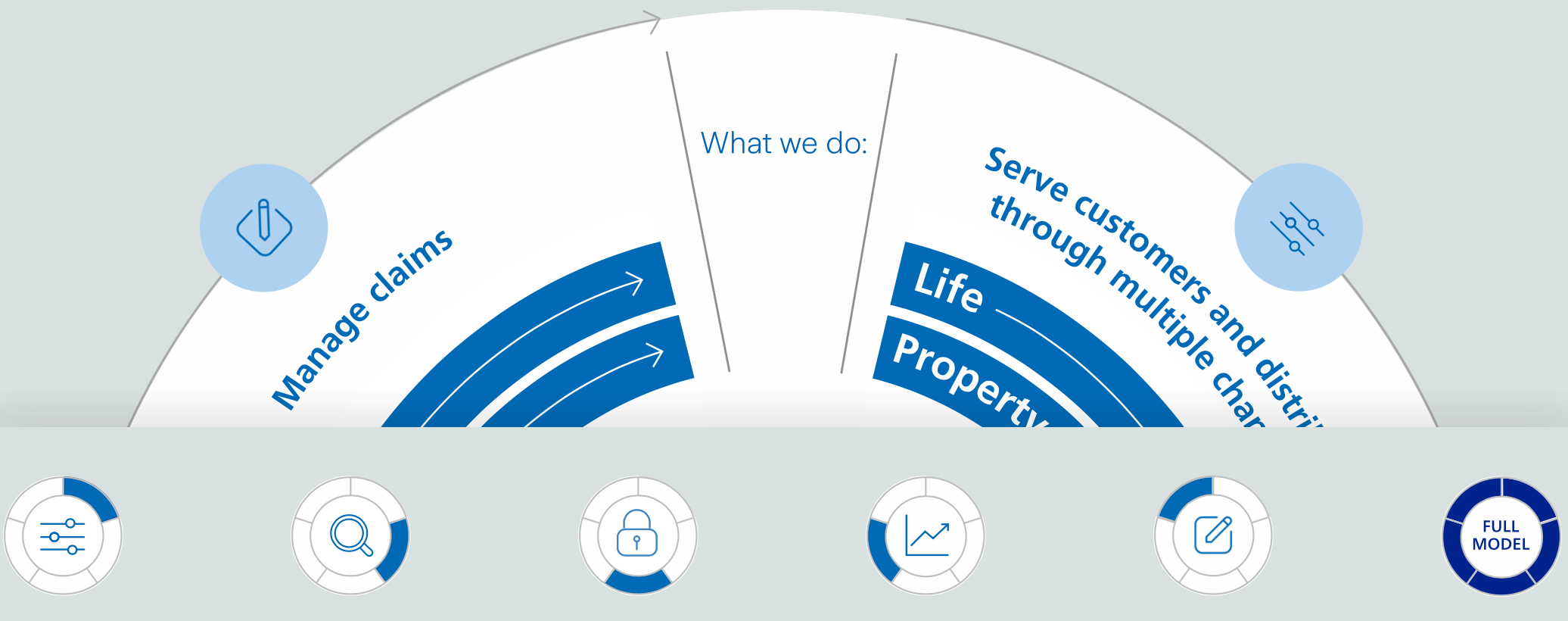

A balanced business

Our business is balanced both geographically and by products and customer segments. Our strong retail and commercial franchise and flexible operating model means we can weather economic and market volatility and take advantage of industry change.

A trusted brand, talented people

We understand the risks our customers face and can structure offerings that meet their needs. This reinforces our global brand, one of the most valuable in the insurance industry. Our strong reputation allows us to attract the best talent worldwide.

Our long-term strategy

Focus on customers

Our transformation to become a truly customer-led company is well underway and we have established a platform from which to evolve and grow.

Simplify

We have successfully simplified our business and operations, to make better use of our resources.

Innovate

We are adapting to make sure we continue to meet and exceed customers’ expectations and needs.

Our targets for 2020-2022

BOPAT ROE1

>14%

and increasing

Compound organic earnings per share growth2

at least

5%

per annum

Swiss Solvency Test ratio3

160%

or above

Net cash remittances

USD

>2 bn

(cumulative)

We see opportunities to grow the business. We will remain cost-driven and continue to simplify the organization. We aim to improve portfolio quality and make better use of capital.

1 Business operating profit after tax return on equity, excluding unrealized gains and losses.

2 Before capital deployment

3 From FY-20 the basis for the Group’s target capital has been changed to the Swiss Solvency Test (SST). Previously the target was based on the Group’s internal Z-ECM basis.

Our business model works to deliver benefits for our stakeholders

Our employees are helping our retail and commercial customers to understand and protect themselves from risk.